Retroactive Tax Credits 2024 California Tax – This means that the value of the credit will be distributed to the taxpayer, regardless of whether a balance is due when filing a return. In California, the state provides a tax credit to parents . Child tax credits are likely to be expanded thanks to a $78 billion tax agreement between the Democrat-led Senate Finance Committee and the Republican-helmed House Ways and Means Committee. .

Retroactive Tax Credits 2024 California Tax

Source : californiapayroll.com

Retroactive Filing for Employee Retention Tax Credit Is Ongoing

Source : www.shrm.org

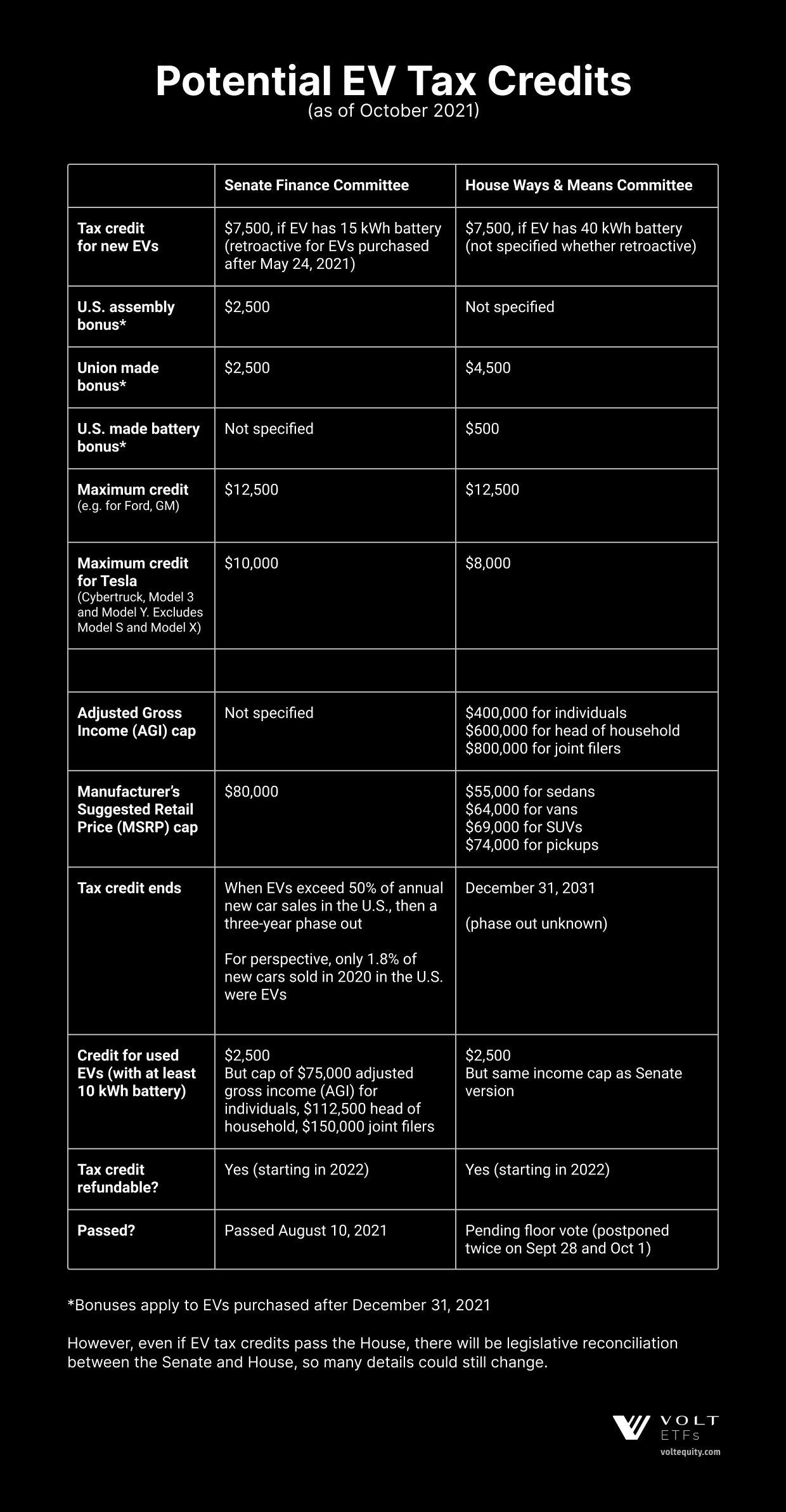

The Tesla EV Tax Credit

Source : www.voltequity.com

ICYMI | Current Developments in California, Florida, Indiana, and

Source : www.cpajournal.com

The Tax Relief for American Families and Workers Act of 2024

Source : www.wolterskluwer.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

Did you know 36 states have enacted PTE tax laws to enable owners

Source : www.tafttaxinsights.com

Carbon Tax Rebate 2024 Dates, Payment Status & Release Date

Source : www.nalandaopenuniversity.com

California Solar Incentives And Tax Credits (2024)

Source : www.architecturaldigest.com

Carbon Tax Rebate 2024 Dates, Payment Status & Release Date

Source : www.nalandaopenuniversity.com

Retroactive Tax Credits 2024 California Tax FUTA Credit Reduction: Impact on California Businesses in 2024: If you live in one of these states, you could be getting another child tax credit payment in addition to the federal amount. . Under the proposed legislation, the child tax credit would increase the maximum refundable child tax credit to $1,800 for 2023 tax returns, $1,900 for the following year, and $2,000 for 2025 tax .